End of Financial Year checklist for Small Businesses

EOFY CHECKLIST

There is a lot to prepare and lodge at the end of a financial year. Here is a checklist for small businesses to consider completing for a smooth beginning in the new year:

- 1. Tax Planning is done 2-3 months before the financial year ends to prepare you for your upcoming tax obligations. The components of your tax return will be discussed during this time, including the tax deductibles that you might be eligible for and ways in which you can legally minimise your tax payable.

- 2. For employers, you need to finalise payroll and super obligations at the end of the financial year. This includes being up-to-date with STP Phase 2.

- 3. Ensure that you are on top of deadlines to avoid paying high fines, interest, and penalties.

- 4. Sort out the debtors, whether they are uncollectible and need to be written off or not.

- 5. Sort out the creditors to know which ones are still outstanding and need to be paid off before the end of the financial year.

- 6. Review your business loans and home loans and their interest rates to help map out the payment scheme for the upcoming year.

- 7. For businesses that buy or sell stocks (e.g., retail stores, salons, warehousing, construction, etc.), prepare a stocktake to report on the ending inventory of the business.

- 8. Compare your business’ income and expenses of the current year with the previous one to see if the business had a healthy operation during the year and plan how to improve as we begin the new year.

- 9. Compare the budget forecasts done at the beginning of the current financial year with the actual numbers to see the performance of the business.

- 10. Review the expenses that can be claimed as a tax deduction and look out for updates from the ATO so you can fully take advantage of any claims to be made.

Technology Boost

The technology boost allows small businesses with an aggregated annual turnover of less than $50 million to claim a 20% tax deduction on eligible expenses for the financial year 2022–23. The total expenses are capped at $100,000, with a maximum tax deductible of $20,000.

In order for the purchased asset to be eligible, it needs to be bought for the purpose of supporting the digital operations of your business. The list below contains examples of eligible expenses:

- Computer hardware: laptops, servers, desktops, etc.

- Equipment: printers, headsets, scanners, photocopiers, video conferencing tools, phones, etc.

- Point of sale systems (POS): cash registers, card readers, etc.

- Computer software: accounting software, payroll software, etc.

- Cloud-based service subscriptions

- eCommerce: website upgrade, website development, etc.

- Digital media and marketing: SEO, social media marketing, marketing analytics, etc.

The Australian government has released the Technology Boost in order to support small businesses in digitising their operations until 30 June 2023.

Instant Asset Write Off and Small Business Energy Incentive

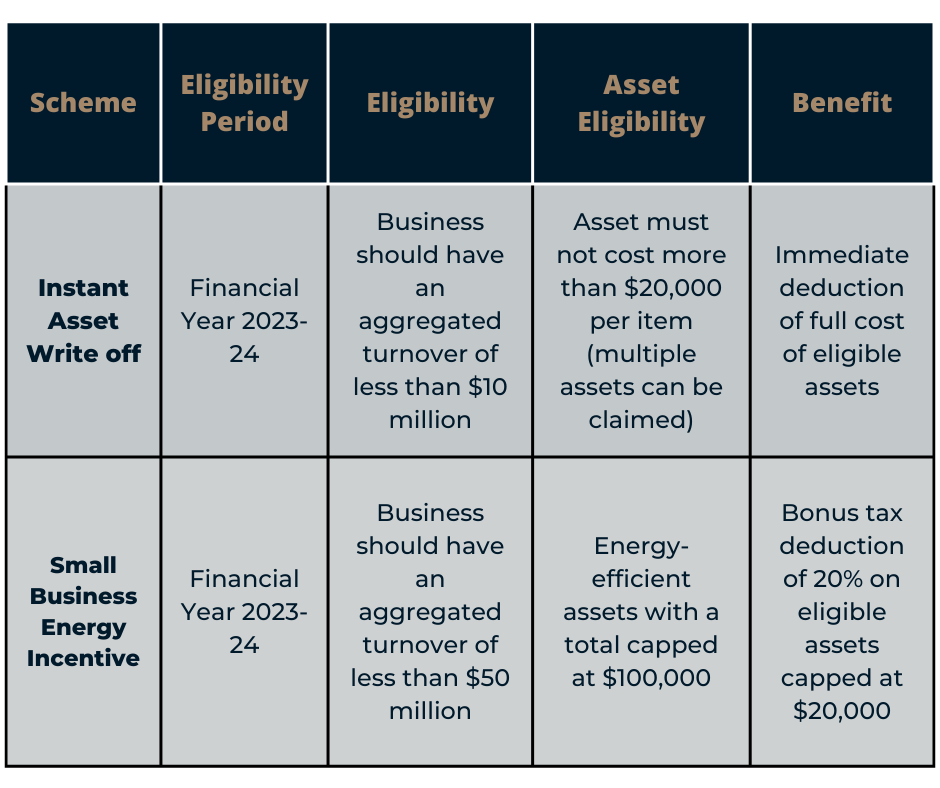

As the instant asset write-off scheme comes to an end on 30, 2023, business owners are debating whether or not to take full advantage of it or wait until the new financial year.

As part of the 2023–24 Budget, the instant asset write-off tax break has been extended for another 12 months. The only catch is that it has been limited to assets purchased for $20,000 or less.

It is said that this tax break is to make way for smaller investments in electronics, machinery, and tools than vehicles. It is also good to note that they haven’t announced any limits on how many assets a business can buy and write-off.

If your business has an annual turnover of less than $10 million, then you might be eligible to use the instant write-off tax break.

At the same time the Australian government has announced that a new tax incentive will be available that will encourage small businesses to make investments in their energy consumption.

The energy conversion is said to not only help businesses save on their power bills but also help Australia lower emissions.

Here are some examples of energy-saving investments that you can consider:

- Upgrading fridges and induction cooktops

- Installing batteries and heat pumps

- Electrifying heating and cooling systems

Eligible assets or upgrades first used or installed ready for use in the financial year 2023–24 (01 July 2023 to 30 June 2024) with a total of up to $100,000 can claim a maximum tax deduction of $20,000.

If you have been planning to purchase assets or upgrade equipment, let’s talk about your plans and how the recent budget announcements may impact them, so we can make sure you aren’t missing out on rebates, concessions or tax breaks.